Having a positive reputation online can often mean the difference between winning the job, or losing the customer. Think about your own browsing habits when deciding on buying a product or requesting a service. How often is your decision swayed by the number of stars on an item listing? Do you look at how the product performs in the real world, beyond the advertised? 88 per cent of customers say that they determine the quality of a local business based on their reviews.

Here are the best practices of online reputation management and exactly how you can make your review forums work in your favour.

The wider your coverage, the stronger your credibility

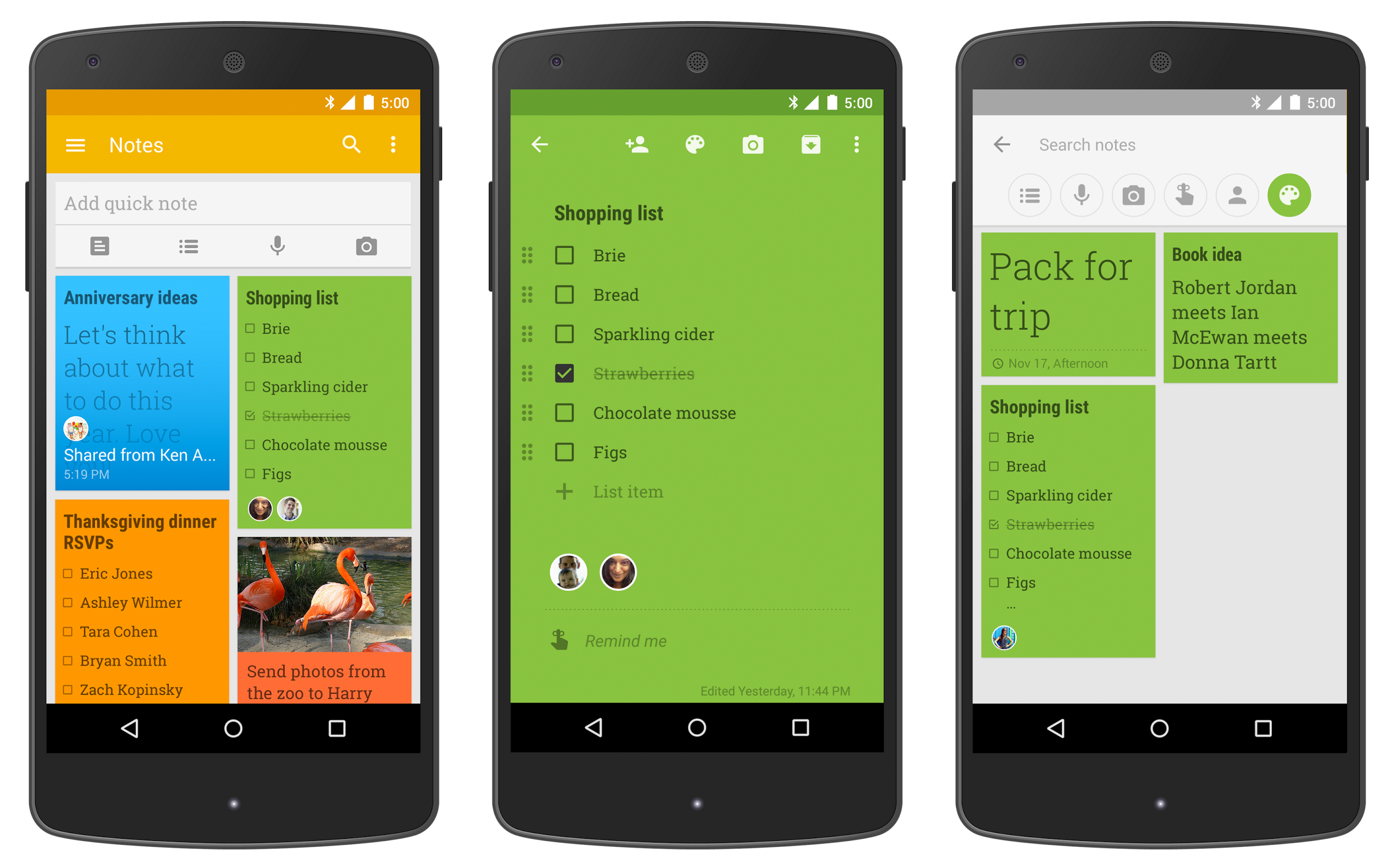

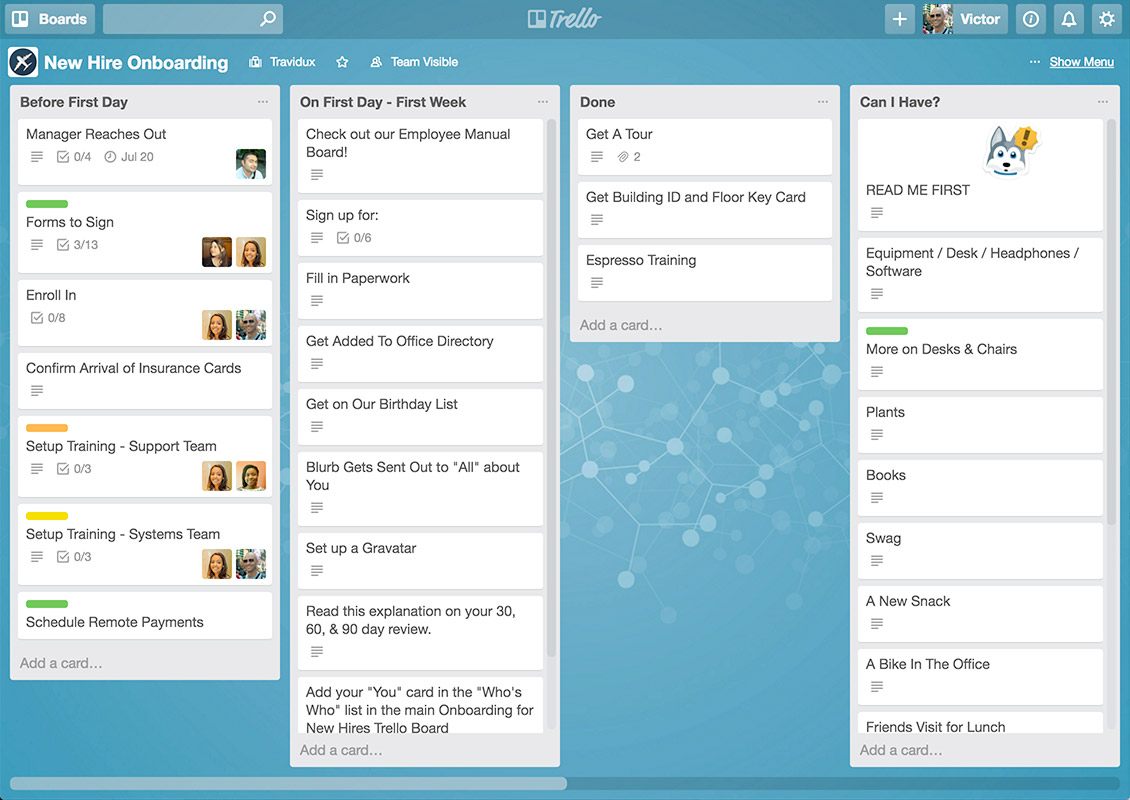

Firstly, ensure you’re set up on a number of trustworthy review platforms and forums such as:

A good starting point is to check out where your competitors are, chances are you should probably be there too.

Eliminate the barriers

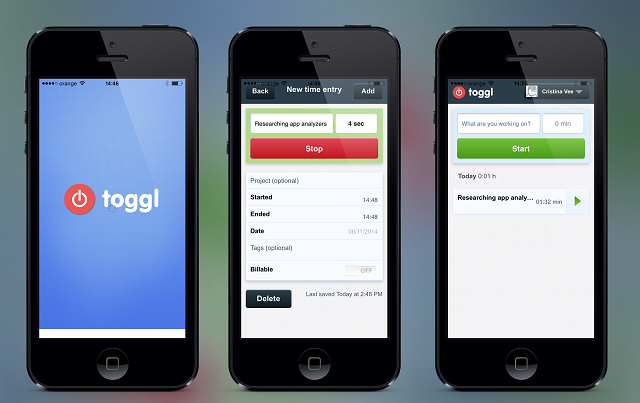

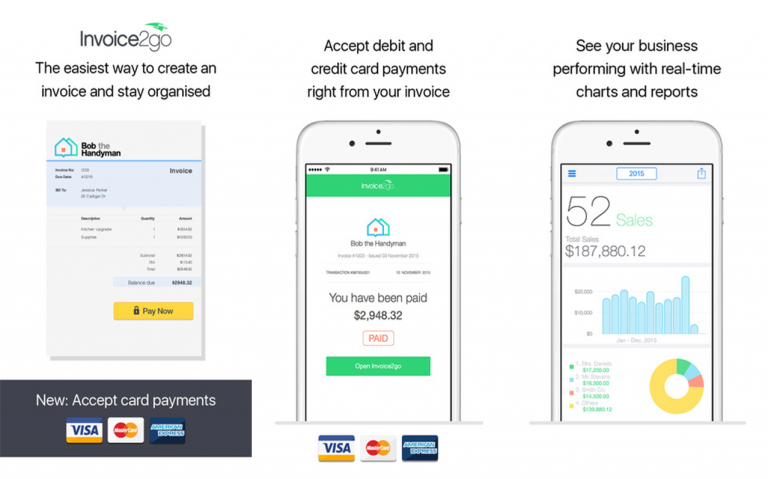

Make it as easy as possible for customers to review your work online. One of the simplest ways to do this is to send clients a direct link to your business’ review page/s via email, SMS or even at the top of your invoice. The review process should be quick and streamlined, not long and tedious. Top-performing Oneflare businesses also suggest a follow-up call to ensure the client was happy with your work might be a good option and, if they are indeed pleased with your performance, it’s the perfect time to ask for a recommendation.

Determine the right timing of the invitation

Ideally, you should engage with your customer and ask them to leave you a review when they’re at their happiest. For example, if you’re a wedding photographer, it might be helpful to ask for a review when you deliver the photos of the big day. Nothing wrong with taking advantage of peak customer satisfaction! If, however, you’re a builder and you’ve been delayed on finishing a project, you may be better off holding off asking until the service is complete.

Incentivise

While you are not legally allowed to buy or pay for a review, you can gamify the process by:

- Placing any one who leaves an honest review (good or bad) in the draw to win something; or

- Organising a ‘surprise and delight’ for one lucky customer who has left an honest review.

Find opportunities

If someone sends you a review via email, text message or over the phone, feel free to either send them the direct link to your preferred review platform or ask them if they’d be happy for you to copy and paste/type out the review on their behalf. Alternatively, you can post it as anonymous.

Include the good, the bad and the brutally honest

A page full of glowing reviews is usually a red flag for prospective customers (fake alert!). Each comment is a useful insight into how your business is performing, so always listen and aim to do better! It is, after all, a valuable learning experience. The aim is to collect as many positive reviews as you can and turn each negative experience into a positive one.

Never reply to a negative review when you’re frustrated

Just like the old adage of never going to bed angry, resist the urge to bite back when you’re upset. Take a breath and take the time to process the comment before responding, you might find you’ll learn some valuable feedback. If you’re certain you’re not in the wrong, make sure to describe what you did to resolve the situation before the review was posted publicly.

Contact local web design experts

Resist the urge to say, ‘I’m sorry you had a bad experience’

Instead, kill ‘em with kindness. Empathise and get on the front foot by showing prospective customers that you are a professional business willing to fix genuine mistakes and rectify the situation if required. Promptly offering an appropriate solution to their problem will likely eventuate in a return customer.

Avoid using emotion or sarcasm

Sarcasm and tone don’t necessarily translate well online. As an attentive service provider, you’ll need to give the customer the benefit of the doubt, while remaining rational, cool and factual at all times.

Act fast

A negative review is a ticking time bomb, so ensure you address the complaint respectfully and appropriately in a timely manner. Leaving the review unanswered can turn away potential clients so make sure to prioritise a response. Interested in learning more? Our Oneflare HQ industry leaders in sales, marketing and SEO can tell you all about new technology and how to build trust with potential customers online. Check out the video here.